http://www.foreignaffairs

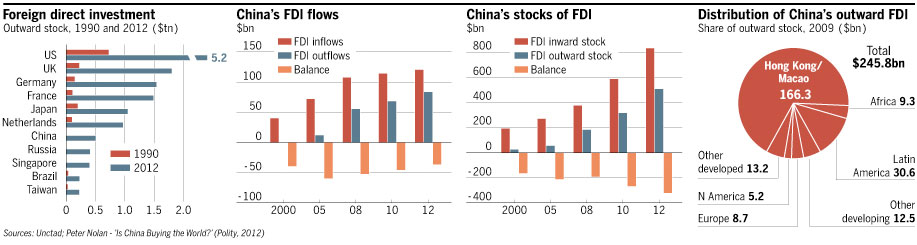

Nolan, a British economist, answers the question in his title with a resounding no. It is true that in recent years China’s state-owned enterprises have been engaged in what is often portrayed as an orgy of acquisitions around the world, particularly in the oil and mineral industries. But the author regards China’s firms merely as latecomers to the extensive global consolidation of business enterprises over the past two decades. He helpfully documents increased global concentration in numerous industries, from brewing beer to building trucks. The national identity of many global firms has become blurred: headquarters are typically still in one place, but assets, employment, production, and sales are widely dispersed, increasingly to emerging markets. It is against this background that China’s foreign investment must be assessed. While that investment has grown rapidly in recent years and many major acquisitions have attracted public attention, in 2009 it amounted to only 1.4 percent of the total direct foreign investments made by the world’s rich countries, and two-thirds of it was directed to Hong Kong and Macao. Meanwhile, China remains largely dependent on foreign technology, and only one indigenous Chinese firm, Huawei, has so far made a global impact.

中國不會買下全世界